This is the year you installed solar power on your RV. While you can now be off-grid, which is exciting, you also qualify for the residential energy credit on your taxes for that new solar power system.

What’s that you ask? The residential energy credit is non-refundable credit on your taxes for your new solar power.

Even better news… the solar tax credit was extended to cover 2021, 2022 and 2023 so there’s still time to add that solar and get a tax credit. It was originally set to expire December 31, 2021.

The credit is 26% for 2021 and 2022 and decreases to 22% for 2023. It is set to expire December 31, 2023 unless it gets extended again. You never know.

Either way I wouldn’t delay if you plan on getting solar for your RV in the couple of years.

What qualifies for the credit

Yes. Your RV, trailer or motorhome qualifies for this residential energy tax credit. This is especially true if the RV is your main or only home, ie. you live full-time in your RV with no other home, condo or apartment.

As defined by the IRS, a home is where you lived and includes both houseboats and mobile homes. Your RV home must have sleeping quarters, a kitchen and bathroom facilities to count as a home.

From all the regulations I’ve seen, I don’t see why a 2nd home or vacation property wouldn’t qualify as long as it can be considered a residence and it’s not commercial property. The latest regulation simply extended the credit that was already in place. I can’t find any regulations that changed the credit to the main home only. That’s good news.

What you need to claim the tax credit

- The receipts for your solar installation. I always suggest keeping good records.

- IRS Form 1040

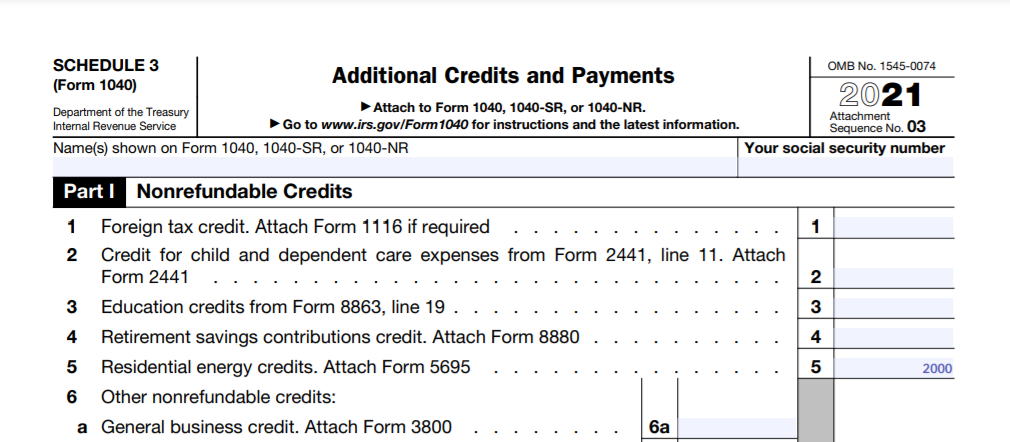

- IRS Schedule 3 as part of Form 1040

- IRS Form 5695

What qualifies as residential energy property?

Yes. Your RV, trailer or motorhome qualifies for this residential energy tax credit. This is especially true if the RV is your main or only home, ie. you live full-time in your RV with no other home, condo or apartment.

As defined by the IRS, a home is where you lived and includes both houseboats and mobile homes. Your RV home must have sleeping quarters, a kitchen and bathroom facilities to count as a home.

From all the regulations I’ve seen, I don’t see why a 2nd home or vacation property wouldn’t qualify as long as it can be considered a residence and it’s not commercial property. The latest regulation simply extended the credit that was already in place. I can’t find any regulations that changed the credit to the main home only. That’s good news.

Taking the credit: Form 5695

Yes. Your RV, trailer or motorhome qualifies for this residential energy tax credit. This is especially true if the RV is your main or only home, ie. you live full-time in your RV with no other home, condo or apartment.

As defined by the IRS, a home is where you lived and includes both houseboats and mobile homes. Your RV home must have sleeping quarters, a kitchen and bathroom facilities to count as a home.

From all the regulations I’ve seen, I don’t see why a 2nd home or vacation property wouldn’t qualify as long as it can be considered a residence and it’s not commercial property. The latest regulation simply extended the credit that was already in place. I can’t find any regulations that changed the credit to the main home only. That’s good news.

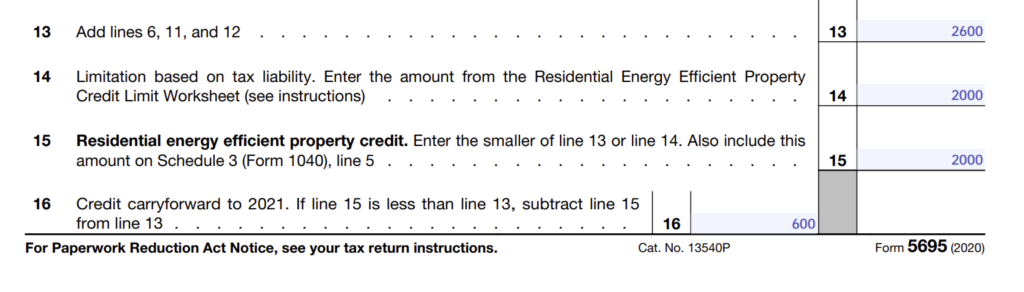

Keep in mind you won’t receive the residential energy credit as a refund if you don’t have any tax liability. Luckily, you can carry over any unused portion of the credit to the next tax year. For example, if you were not able to claim the whole credit on your 2021 taxes, you get to reduce your 2022 tax bill, too. A tax liability calculation worksheet is provided in the instructions for Form 5695. This allows you to add up your tax credits to see how much of the solar energy credit you qualify to take.

Form 1040 Schedule 3 Line 53

Below is an example of how your credit amount will show up on Form 1040. If your solar energy system cost you $10,000, your taxes are reduced by a credit of $2,600. However, if you only have a tax obligation of $2,000, that’s all the credit you can claim for that tax year. You can carry the other $600 credit over to the next tax year.

When to take the credit

All costs are treated as paid when the original installation of the item is complete. Therefore, you can claim all the costs for your installation no matter when they were paid, but you must wait to claim them the year the installation is complete and your solar power is 100% functional. Keep all of your receipts and documents related to the installation.

Let’s take a look at a scenario. Let’s say you bought the batteries and panels in November 2021. Then you had them installed on your RV in January 2022. You qualify to take the credit for all the components and installation costs in 2022 because that’s the year solar power was fully functional on your RV.

Adding new equipment

If you already have a fully functional solar system on your RV, but you add more batteries and/or solar panels for an update, you can claim the credit for any new costs associated with the addition. However, you can’t go back and claim the credit for the previously installed equipment.

Hopefully, you already claimed the credit for those costs back then. It is required that you install new panels to be able to take this credit. If you simply want to add more batteries to your system, I suggest adding a new panel as well to take advantage of this credit.

If you buy an RV with solar already installed, you do NOT qualify for the credit. If you add panels to upgrade or enlarge the system, then you could qualify.

No repayment necessary

If you install a residential solar power system on a home (an RV qualifies as a home) you own, you can claim the whole credit and sell at any point afterward with no repayment necessary. Keep in mind this is only true for residential solar power including your RV. The law is significantly more complex for commercial solar installations.

You may also choose to move your solar panels and batteries to a new RV should you change your rig. There’s no repayment necessary there either. Nor do you get to take any credit again unless you add new panels to your system.

Keep records

It is important to keep records of all your receipts for your solar install. You can do this digitally if you like. This includes not only receipts for all the solar components like panels, batteries, wires, inverters, etc., but also for any labor for the install. These are for your records should the IRS question any credit you take. If you want to be extra organized, you can keep a spreadsheet with the date of each item purchased or labor and the cost. This will help make it easy at tax time to figure your solar energy credit.

Taking the residential energy credit for your solar power is actually quite simple and a pretty nice bonus for those who plan to be off-grid with their RV. If you still have questions or concerns, I suggest you talk with a tax professional to get answers for your specific situation.

Author

Heather Ryan

Heather is the owner of Tax Queen, a tax firm supporting entrepreneurs and digital nomads. As a federally-licensed Enrolled Agent, she supports her clients year-round with tax preparation, tax planning and bookkeeping for RV entrepreneurs. She also educates digital nomads and entrepreneurs through her blog posts and has written a book, Taxes for RV Owners, to help RV owners understand deductions and taxes. She hit the road in September 2016 and travels in a 5th wheel with her husband and two dogs.

Did you like this post? Pin it on Pinterest!