Tax time can be a big stressor for many. If the thought of tax time brings up frustrations or makes you shudder, have no fear. I have helped many RVers plan ahead for tax time. Follow these tips to help ease your stress!

While taxes are not the most fun thing in life, they are a given if you earn any income. If you can’t make them go away, then you might as well embrace them, right? At the very least, maybe you’ll procrastinate a little less if it’s easier and takes less time.

Here are some tips to help file your tax return and should I say, make it less taxing.

Kidding aside. You can prepare for tax time throughout the year so that it is a little less stressful.

Get and Stay Organized

If you’re tired of not having everything handy and stressing out over finding receipts, income records, and expenses, then it’s time to get organized. Once you’re organized, it’s easier to stay on track year after year.

Staying organized means tracking items as they happen. This can be medical expenses, business expenses, and income, charitable donations, IRA contributions, etc. If you’re not sure what counts as a deduction or credit or what you need to be tracking, then grab last year’s tax return. If you see what you took on last year’s return, it can help you know what’s important to track.

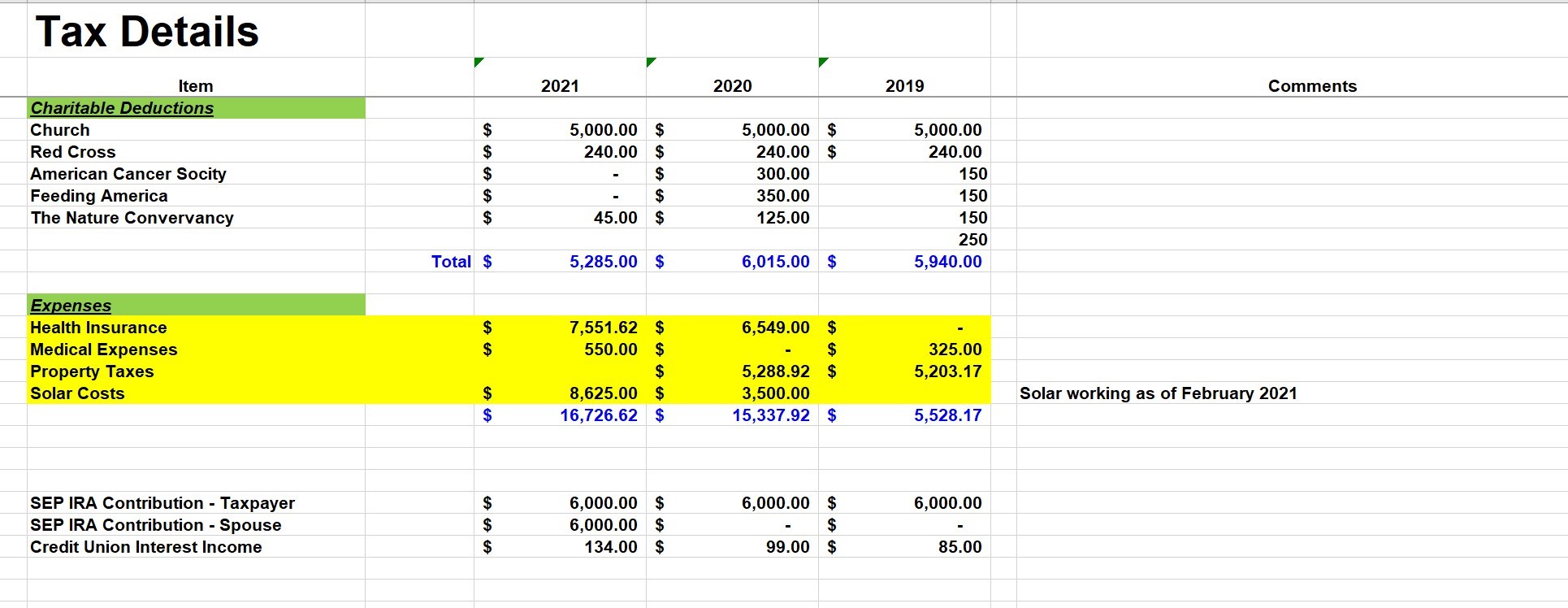

If you are a business owner, you should have either a spreadsheet or be using accounting software for all your business income and expenses. This helps you keep track of deductions easily and you can compare year-to-year to see if you missed anything. There’s accounting software for every budget and expertise level out there, so find one that fits you. Examples include Wave, Freshbooks, Quickbooks, Xero. If you don’t want to use bookkeeping software, use a spreadsheet to track business income and expenses at the very least.

For all taxpayers, you might try creating a tax spreadsheet on your own to keep all your accounts. That way you won’t forget about that extra savings account and the interest it earned.

The spreadsheet can track all possible deductions including healthcare costs (including mileage for medical appointments), education expenses, estimated taxes paid, IRA contributions, etc. in addition to any tax deductions or credits you took last year. This way, you stay organized and don’t miss out on a valuable deduction or credit.

Healthcare costs include health and dental insurance premiums (for those not covered under an employer plan only), doctor co-pays, eyeglasses, dentist costs, medications, medical equipment, and even medical mileage. Especially when you live in an RV, medical mileage can really add up.

Receipts

If you have receipts, then it’s important to keep them organized as well. No need for paper receipts anymore. The IRS allows electronic copies and honestly, paper receipts fade with time making them impossible to read in a matter of months.

Receipts aren’t just for businesses! They can be personal as well. Personal receipts can be for charitable contributions, childcare, healthcare, medical expenses, retirement or HSA contributions, tax payments, bill of sale for an RV/auto, solar for your RV, and more. It’s important to keep a copy of all these documents. Scan them or take a photo. Then store them in your electronic, secure tax folder. I suggest making a new folder each year. Also, make sure to name the electronic receipt with the year and the item (medical expense).

Think about it. If you buy and install solar in January 2021, are you going to remember the exact cost a year later at tax time? Probably not. Why not take those receipts and keep them in one tax folder so it’s easy to find a year later. It takes the guesswork and frustration out of the equation.

There are lots of ways to stay organized with receipts. You can take photos with your phone and add them directly into accounting software as an expense if it’s business-related. If they are personal receipts, then take a photo and keep that photo electronically in a special tax folder that’s easy to find later.

If the receipt is already electronic, then it’s even easier. Download the pdf or print a pdf of the item and drop it in your tax folder. This doesn’t take much time and it will definitely save you time, energy, and frustration when tax time comes around. Make sure to name it with the tax year and the item i.e. 2021_Charity Donation_RedCross

You can even use software like Evernote to keep organized and store everything electronically. You get the idea here, right? Use tools to help you stay organized and keep things simple.

Whichever method you pick, the most important thing is to stay organized and to keep electronic records of all your tax documents. I promise this makes tax time less stressful. You won’t have to dig to find receipts and records or remember how much you spent where.

Use a checklist to help plan ahead

It’s good to be prepared and organized with all your documents whether you plan on preparing your own tax return or using a professional tax preparer. Use my tax prep checklist or the IRS list to check off all the items of income, expenses, and deductions. This should help you avoid missing any deductions or credits available to you.

As you receive the paperwork for any of the items on the tax prep checklist, check the item off. Once everything is checked off, you know you are ready to file. I know it’s not always easy waiting on tax documents since they can arrive sporadically. Having a template or folder will definitely help you be ready for tax time and hopefully, alleviate some stress.

If you create your own tax organizer, you can copy and edit it from year to year. If anything changes, simply add it in or possibly remove that line for that tax year.

If you don’t enjoy updating a spreadsheet, then at the very least keep all tax documents in one secure (and backed up) folder electronically. Sound familiar? Yes. I’m repeating this stay-organized concept because it’s so important to track all these items throughout the year.

Mileage Records for Business Owners

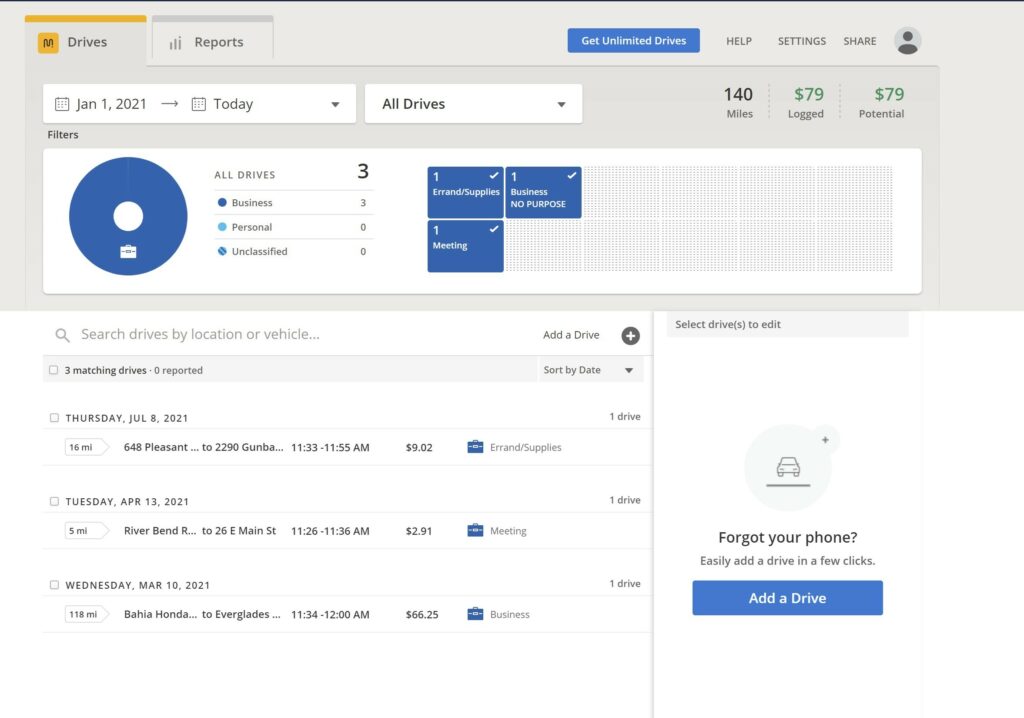

If you use your truck or auto for business errands or meetings, then remember to record your miles in a travel log or mile tracker app like MileIQ. If you use Quickbooks, it has a built-in mileage tracker.

Yes. Do this all year long in real-time because recreating it after the fact is extremely time-consuming. Plus, you’ll most likely miss something. I know I can’t always remember what I did last week, let alone last month or three months ago.

Business mileage should show the date, the business purpose (i.e. meeting with client John S.), location, and ideally the starting and ending mileage of your auto. If you don’t have the start and ending mileage, recording the number of miles driven is okay. This is why apps are so nice for this because they record the GPS. You’ll also want to record the beginning and end of the year miles on your auto. That part is easy. On December 31 or January 1, record the odometer reading on your vehicle. Now you have both the end of year and beginning of year mileage. You’ll need all this information when it comes to tax time.

Here’s an example snapshot of MileIQ. If you have the app on your phone, it will automatically record your to and from locations, date, etc. There are other apps out there as well so just use this as an example.

Other Items to Help RVers Plan Ahead for Tax Time

If you have rental property, record all expenses related to the property as they come up (taxes, cleaning, yard work, HOA dues, repairs, upgrades). This way you won’t have to scramble come tax time and struggle to remember expenses or income related to the property. Also, keep records of any receipts related to these expenses.

If you buy and sell virtual currency, make sure you are tracking dates and costs. This is called your basis. There are trackers out there you can use like CoinTracker to help you with this.

The same goes for stock and partnership/corporation ownership. Make sure you are aware of your basis and initial cost. With partnerships and corporations, your basis will fluctuate every year. If you use a professional tax preparer, they should track and provide basis information for any business owner.

If you stay on track every year, then tax time will be easier and less stressful. You can share a tax folder with your tax professional or use it yourself so you’re not searching all over for the data. Having it all in one place should make tax time a little less stressful for you.

Most importantly find a way that works for you to stay organized and use it regularly. Put it on your calendar to enter data weekly, monthly or quarterly; whatever feels right to you. I promise if you stay on top of things, it won’t feel so daunting later. Once you’re organized, you shouldn’t freak out over your taxes anymore! Less stress is a good thing, right? Plus, it will take less time to file a tax return leaving more time for fun with the family.

Did you like this post? Pin it on Pinterest!

Author

Heather Ryan

Heather is the owner of Tax Queen, a tax firm supporting entrepreneurs and digital nomads. As a federally-licensed Enrolled Agent, she supports her clients year-round with tax preparation, tax planning and bookkeeping for RV entrepreneurs. She also educates digital nomads and entrepreneurs through her blog posts and has written a book, Taxes for RV Owners, and created a course, Finances for the RV Entrepreneur, to help RV owners navigate the world of finances and taxes. She hit the road in September 2016 and travels in a 5th wheel with her husband and two dogs.