When you go on the road, there are many things you can leave behind. Two things that you can’t are money and banking. RVers need to bank just like everyone else, and thankfully our modern world makes that superbly easy to do.

Banking options are more plentiful than ever, and pretty much any of them will work on the road as long as they provide robust online services & nationwide access. Still, there are a few specific issues that RVers should be aware of if they want to maximize their flexibility & access to money on the road. Hopefully this post will help you sort that out.

Note: I am not recommending any specific bank or service. Everyone has their own needs and preferences, so I encourage you do your own research first. Happy RV Banking!

What Are The Options?

So what kinds of banks do RVers actually use on the road? The answer is all kinds, depending on individual needs, and they each have their pros and cons:

Traditional “brick and mortar” type banks (e.g. Chase, Wells Fargo, Bank of America, HSBC) are the “old school” banks we all grew up with. They offer the advantage of large nationwide networks of physical branches/ATMs as well as the full suite of financial services from regular banking to investing & retirement. Maintaining all that “stuff” however is costly, so they often charge monthly account fees (depending on your account levels) and have fairly poor savings rates.

Online only banks (e.g. Ally, Capital One 360, Axos) have roared onto the market in recent years and are a solid alternative if you don’t mind doing everything online. Since they don’t have to maintain buildings, they can offer low-cost or no-cost banking, higher savings rates, and of course they all have robust online services. You won’t get that in-person touch here though.

Many brokerages also offer banking services these days (e.g. Charles Schwab, Fidelity, TD Bank etc.) They tend to be very low-cost (no checking fees, all ATM fees refunded) and are quite handy if you want to combine your investing & banking services into one. Again however, you won’t get that in-person touch here.

Credit Unions (e.g. Alliant, Connexus, First Tech, PenFed etc.) are a non-profit alternative. You have to be a member to join, but they are known for great customer service and flexibility (for example, I’ve known fulltime RVers who’ve managed to get loans at credit unions, which traditional banks wouldn’t touch). Credit unions may not be as “tech savvy” or offer as full a range of financial services as the bigger banks, but many offer online banking and nationwide access (e.g. through CO-OP).

Military Banks such as USAA and Navy Federal Credit Union are yet another alternative for those who have served. They tend to have great reputations, and the added advantage of being used to dealing with families who travel and live abroad.

Consider More Than One Bank Account

Perhaps one of the most useful pieces of advice I can give folks going on the road is to consider having more than one bank account, simply because you never know what could happen that might cut you off from one of your accounts while you’re traveling.

We’ve had two bad experiences that have taught us the value of this:

Locked Out Of Our Main Account – In our second year RVing Wells Fargo suddenly decided to freeze our main checking account access on a technicality, and insisted we physically go into our “home” branch to fix it, which obviously we couldn’t do! Thankfully, we had another bank account we could use, while we worked it all out.

Stolen Wallet – Another bad experience was the day my wallet got stolen, with our only debit & credit card in it. This caused a great deal of grief over the next weeks as we tried to navigate how to get replacement cards (our bank wouldn’t send to PO General Delivery), while not being able to pay for anything. A separate account & set of cards would have made life so much easier.

I realize not everyone wants the hassle of managing more than one bank account, but it really does maximize your flexibility should anything go wrong. And it doesn’t have to be expensive! If you have a traditional bank or a credit union as your main account, consider adding an online bank or a brokerage-linked bank as an inexpensive (no fees) backup. Same with credit cards if you carry them. In addition to your “main” credit card, consider at least one other no fee card from another bank, tucked away in a safe place in case you need it.

Have Access to a Physical Address You Can Use

Another key issue that RVers need to be aware of is the Patriot Act. Passed in 2001 to protect against money laundering and terrorist financing, Section 326 of the Patriot Act requires all financial institutions to have verifiable proof of their customer identities. Amongst other things this includes having a physical, residential address on file.

For part-time travelers this is not a problem, but for full-timers this can become a major issue as many mail forwarding services (as well as PO boxes and such) are automatically flagged as “non-residential”. Now, the Patriot Act does have a specific exception that allows individuals without a physical address to use the address of a next of kin or other contact individual. In practice however, banks don’t always accept that!

In 10 years of RVing we’ve been hit twice by this, with the bank threatening to close our account if we couldn’t provide a residential address. In both cases we were able to give the address of a family member (in the same state as our domicile) as the main address on file, keeping our mail forwarding service as the “mailing address”. However, one of our institutions also required proof of the main address, which was trickier. We managed to work it out by using a cellphone bill and a statement from another bank (yeah to back-ups, yet again!) that had that same address on it.

Phew! All that to say, just make sure you have access to a physical address you can use, with proof.

Look For Banks With Robust Online Services

For most RVers online banking is the only type of banking they’ll ever do. During our 10 years on the road we went into a physical bank maybe twice (?), but we used our online services constantly. So, having access to a solid website where we could easily manage our money was key. No matter which bank you choose, make sure you test/demo their online access, including any smartphone/pad apps (if that’s important to you), to ensure that they offer absolutely all the services you need.

Some things we consider critical:

- Online transactions & history – every bank with an online service should provide detailed transaction history, and it’s important that you check this regularly, not only for budgeting purposes, but also for errors & signs of fraud. Personally, I also think it’s important that this history can be downloaded. We are old-school so we download all our expenses via CSV into a monthly Excel file, but many banks integrate with snazzier services such as QuickBooks. Whatever way you choose to track your expenses & budget, make sure it’s easy and foolproof so that you stay on-track with your RV budget!

- Online bill-pay – even as a full-time RVer you’ll need to be able to pay bills, businesses and individuals, and not all of these will accept credit cards. Online or electronic bill pay allows you deal with this without having to send a physical check in the mail.

- Person to person payments – An especially useful addition to online BillPay is the ability to make quick, easy person-to-person payments, allowing you to transfer money from your account to someone else’s electronically. Many banks use a service call Zelle® for this (e.g. Chase, Wells Fargo, Bank of America, PNC, Capital One etc.), but there are also independent services that offer a similar thing (e.g. Paypal Venmo, Transferwise etc.).

- Online check deposit – if you happen to receive a check in the mail, it is truly handy to be able to deposit it online, without having to mail it in or deposit it in person at a branch. Thankfully, many banks offer this service nowadays through apps, allowing you to endorse & then deposit your check via a photo on your phone or pad. Note that there is always a limit to how much you can deposit through the mobile app (anywhere from $500 and up), and this varies a ton by bank. The online-only banks have by far the biggest $$ allowances, so if you regularly need to make check deposits on the road that is a big point in their favor.

- Link to external accounts – If you have other financial accounts such as investment or retirement accounts, business & personal accounts, having the ability to easily link and transfer money electronically between them is key. Once the external account is verified (typically using trial deposits), you can usually transfer money for free using ACH transfers. Note that not all accounts can be linked, and there are limits to how much you can push/pull (anywhere from $2,000 to $10,000 per day, depending on your bank & account level), so just check that whatever your bank offers meet your needs.

- Online alerts & freeze/Stop access – two extra features which we really value are the ability to set-up online alerts (for transactions, withdrawals, payments etc.) as well as the ability to temporarily freeze a debit or credit card online if it is lost or stolen. This helps us to monitor our accounts and stop them if needed.

There are many other online services which might be important to you, depending on your situation (e.g. access to investing & savings accounts, online chat services, credit monitoring etc.) so just make sure your bank offers what you need before you sign-up.

Get A Debit Card With Nationwide, Low-Cost ATM Access

Although you may never need to go inside a bank branch, you will certainly want to access cash during your travels for smaller things such as laundry, farmers markets and the such. Your bank debit card will allow you to do this, either by using cash-back services (e.g. when paying with debit at stores) or by withdrawing from ATMs. For the latter however, you may be charged a fee (anywhere from $2-5) if you use a non-network machine, so you’ll want to ensure your bank offers one of the following:

- The bank has a large, nationwide network of own-branch ATMs. All of the traditional “brick and mortar banks” qualify here. The largest three are Chase (~5,000 branches in 35 states, ~18,600 ATMs), Bank of America (~4,300 branches in 37 states, ~16,000 ATMs), and Wells Fargo (~5,500 branches in 42 states, ~12,800 ATMs). Basically, Chase has the most branches/ATMs, but are not in all states, whereas Wells Fargo has the most expansive (nationwide) network.

- The bank is linked to a large nationwide network. You might think online banks or credit unions would be at a disadvantage when it comes to cash withdrawals, but many of them participate in one or more ATM networks, and these can actually be huge! In the USA the three biggest networks are Allpoint (~55,000 outlets), MoneyPass (~32,000 outlets) and CO-OP (~30,000 outlets). So, for example, both Ally & Capital One 360 (online banks) participate in the Allpoint network, whereas the majority of credit unions participate in CO-OP.

- The bank refunds your ATM fees. In addition to networks, some banks go the extra mile and either refund a portion or all of your ATM fees, if you happen to use a non-network machine. So, for example Ally (online bank) will refund up to $10 of fees per month, whereas Charles Schwab (brokerage bank) will refund unlimited ATM fees, even internationally!

Consider a Few Credit Cards (If Paid Off In Full Monthly)

I know some people don’t like credit cards, mostly because they can become a slippery slope into debt, but personally I think they’re an extremely useful tool on the road if used responsibly (i.e. not to buy things you cannot afford), and paid off in full every month.

As long as you have this strict discipline, using a credit card (rather than a debit card or cash, for example) can offer a lot of advantages:

- Enhanced fraud & consumer protection -> credit cards are not directly linked to your savings/checking accounts, so if someone steals your credit card info, you can simply shut-down the card without having to shut-down access to your entire bank account

- Warranty extensions -> many cards offer extended warranties on electronics & other purchases

- Travel & rental car insurance -> many cards offer free travel & supplemental rental car insurance in case you fly somewhere or rent a car

- Price & Purchase Protection -> Some credit cards offer price protection on your purchases (i.e. they’ll refund a portion if the price of an item drops within 30-60 days), whereas others will offer extra purchase protection such as theft and accidental damage.

- Points or cash-back programs -> many cards offer points programs or cash-back to give you a return on your purchases. This is especially nice for larger RV expenses such as gas, campgrounds and groceries. With the right cards, you can get 1.5-5% back for almost everything you pay for!

We are points geeks and like having multiple backups, so we carry a selection of credit cards from various banks, to maximize our returns. The points we have accumulated over the years have allowed us to fly home, or fly family to see us for free multiple times per year. It’s been great.

As with our bank accounts, security & monitoring is key for all our credit cards. We set-up online alerts for transactions & balance so we can monitor for fraud, we regularly download & check our transactions, and of course we have automatic payments set-up to pay off the cards in full every month.

Specifics for Business Banking

If you run a business on the road, you’ll need a business account in addition to your personal accounts. All the same requirements (security, online availability, ability to download transactions, ease of payment/deposit,) apply here, except you will probably need access to higher levels of online deposits and payments (e.g. more frequent, higher $$). Plus, as your business grows, you may want additional services such as small business loans, merchant services, invoicing, & payroll processing. Seamless integration with external business accounting tools (such as Quickbooks) is also really handy.

Many RVers chose to have business accounts with one of the “traditional guys” (e.g. Chase, Wells Fargo, Bank of America) since they are well-established for small business and offer all of these services as standard, but we also know entrepreneurs who use online only banks (e.g. Azlo is particularly popular) or credit unions for their businesses.

As with personal accounts, I do recommend more than one business account in case something happens to your main account while you are on the road.

Specifics for International RV Travels and Mobile Banking

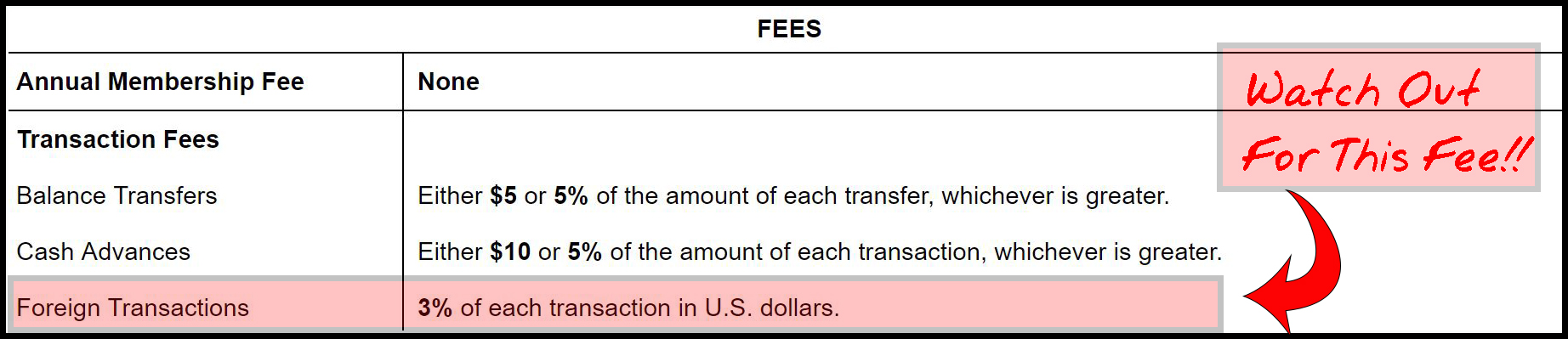

If your RV plans include international travel, there are a few extra banking fees that you need to be aware of. Obviously you’ll have to deal with exchange rates from US$ to whatever currency you’re dealing with (these rates are fixed by your bank/card and cannot be avoided), but there are two additional fees, specifically foreign ATM withdrawal fees and foreign transaction fees, that can be hugely expensive (2-3% of total costs), but are also easily avoidable!

So, if you plan to RV internationally, I recommend adding the following to your banking inventory:

- For withdrawing cash -> Get a debit card that has NO foreign transaction fees, and also refunds all international ATM fees. For example, Charles Schwab high yield checking account offers this.

- For purchases -> Get a credit card with NO foreign transaction fees. In addition, a card that offers chip & pin as a payment option is nice, in case you RV somewhere (e.g. many places in Europe) where certain gas & train stations are not manned. Several US banks do offer this now.

Deposit Insurance and Security Concerns

A last word on insurance & security. It goes without saying that both of these should be a given with any bank that you choose, whether you’re RVing or not, so if they’re not offered run far, far away!

- Deposit Insurance – This is critical as it safeguards the money in your deposit & savings accounts in case your bank collapses or fails. For traditional and online banks, deposits should be FDIC (Federal Deposit Insurance Corporation) insured. For credit unions stick to NCUSIF (National Credit Union Share Insurance Fund) insured institutions. The standard for both is $250,000 per account holder per bank.

- Online Security – All modern banks use encryption to create a secure end-to-end connection with your browser whenever you log-on (always check for “https://” at the beginning of the page’s URL/web address. The “S” is the secure indicator here -> don’t log on if doesn’t show!). This should keep your transactions secure, no matter what WiFi you are using. That said, I always recommend sticking to private WiFi network whenever you are accessing sensitive personal information and/or using a VPN (Virtual Private Network) as an added layer security.

- Two-Factor Authentication – If you bank offers two-factor authentication, always take advantage of that! Two-factor is an extra login security feature, usually an extra code that you need to input from either a phone text, physical dongle, or some other method when you log on to your account. It’s well worth it.

In addition to I highly recommend keeping a separate record of all your bank & card details (debit/credit card & account numbers + contact phone numbers) someplace safe, either written down in a physical safe, or online in an encrypted file, in case your cards are lost are stolen on the road. We wish we’d had this when we lost my wallet!

Good RV Banking to You!

Hopefully, this gave you a useful overview of banking options on the road. As I mentioned in the beginning of the post, there are lots of options and no one “right” answer. We’ve met RVers who happily bank with either traditional guys, online guys, credit unions or some combo thereof.

In our case we have several bank accounts both for our personal & business use (we use a combo of Wells Fargo Personal & Business, Charles Schwab, and Paypal), as well as a selection of credit cards, including several with no foreign transaction fees. We’re able to do everything we need online, and we can withdraw cash & pay for our RV travels worldwide with no added fees. It works for us!

Here’s hoping you find the perfect combo for you!

Author

Nina Fussing SKP#106238

Nina Fussing is a blogger, photographer and all-around nature-lover who spent 8 years fulltime RVing with her hubby & 12 paws around USA. They are now in Europe continuing the adventure there.

Follow their story at: wheelingit.us

11 Responses

Great article, very informative! Thanks for laying out so many factors to consider and the different options.

Great info.

From my experience, my AmEx Card was threatened with closure since I didn’t have a physical address. I called, chatted, or went self-service online after every email or paper mail. Every time it was “fully resolved”, until it wasn’t. This went on for probably a dozen times over 9 months, until it didn’t. Not sure why, but they accepted the last one for more than 2 years.

Just 3 months ago, TDI Ameritrade complained. Sent them a picture of my driver’s license with my address, they haven’t complained again.

It seems to help to say that I while I like to use and/or invest through you, I have other accounts that accept my life style.

We’ve also found AmEx to be more difficult than others when it comes to the whole address thing. They were actually the reason we ended up switching our cellphone bill (and one bank address) to a relative. It was the only thing that stopped them.

Nina

Good article, Nina. I’d like to add some thoughts about using credit unions, though. We are full-timers and are generally perfectly happy with the service we receive from our credit union based in Nevada. When we need a good chunk of cash, however, the fact that it’s based in a specific state proves to be a challenge.

For example, say you’re in Colorado and you found a great deal on a trailer and you need to take $5000 out right away. While you do have “shared banking” when you’re in other states, our experience has been that there is a limit to how much you can withdraw – $1000 a day maybe. I don’t know if that’s the case with all credit unions, but I can say it’s been a real sticking point for us. I also find that not all credit unions are shared banks with mine, which reduces the access even more. Yes, there’s ATM, but the daily withdrawal limit on those is even smaller.

We are on fixed income, so having balances in two banks is not really very practical for us. We have decided to go to a national commercial bank so access to our money is not so darn frustrating.

Very good info Tawnya. We’ve never personally dealt with credit unions, so it’s good to hear your perspective. I wonder if other RVers have run into that problem? I do think you’ll find the problems you mentioned easier with one of the regular brick & mortar banks. Hope the switch goes smoothly!

Nina

Excellent article Nina!

We’ve been fulltimeers since 2002 and have never had to use an ATM or otherwise had to pay a fee to obtain cash. Many (most) retailers allow debit card cashback withdrawals without a fee when purchases are made — often $100 or more per purchase. For larger amounts, a visit to any handy (not our own) bank teller has always resulted in the needed debit card cash withdrawal — without ever being charged a fee.

I have transferred my residence from Missouri to Livingston Tx Escapees. My Capital One Credit card will not take my new Escapees Address (Livingston, Tx) as a Physical Address. I understand you can use another address as a Physical Address, however I really want to use my Livingston Address as the physical address. Has anyone figured out a way to use Livingston as the physical address?

Hello Gregory. If Capital One won’t accept Livingston as your physical address, then you can’t use it. You can only use it as your mailing address. The explanation is here: https://escapees.com/mail-service/escapees-mail-service-faq/ Scroll down to the section for Banks and Credit Unions.

Hi Greg, I have been using my Rainbow Drive address for Capital One for a long time….however I sometimes wish I wasn’t, as Capital One mailer/ads are one of the only pieces of junk mail I get and I can’t figure out a way to stop it!